ASPIRE: Financial Aid & FAFSA

FAFSA (Free Application for Federal Student Aid)

Class of 2025 Seniors: The US Department of Education announced that the FAFSA is now open!. ASPIRE will hold workshops to help students and families complete this application. You can also schedule a meeting with ASPIRE to complete the FAFSA.

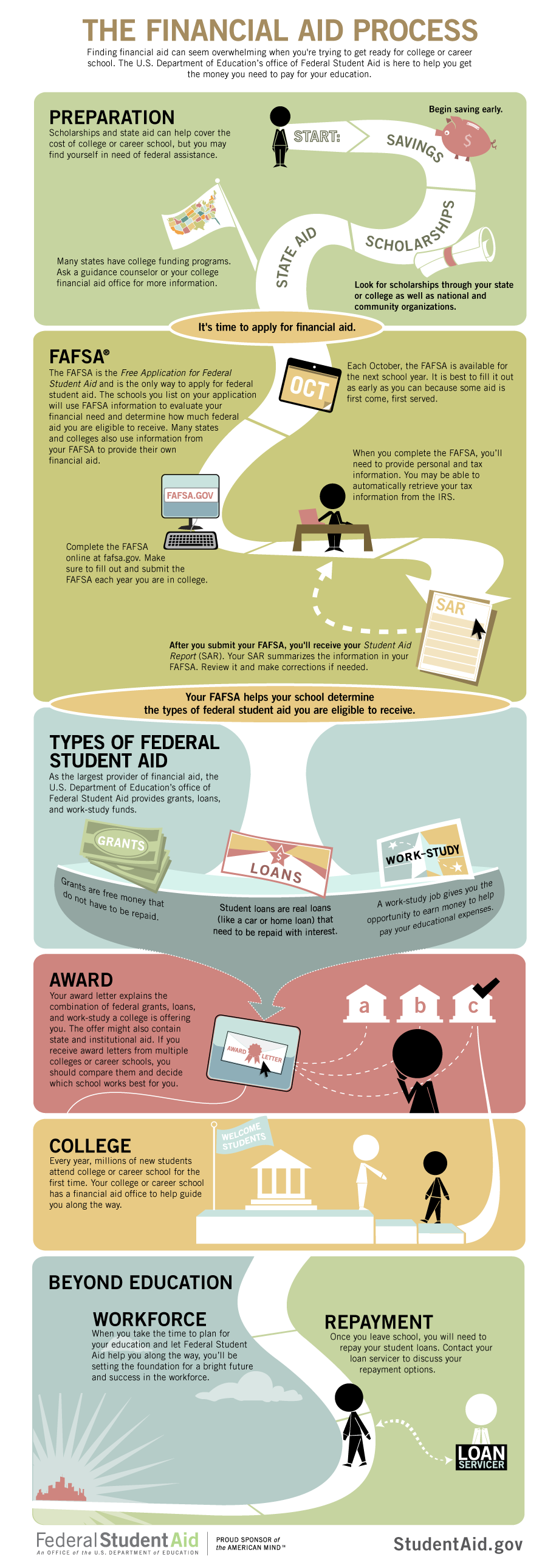

The FAFSA (Free Application for Federal Student Aid) is the starting point for all college financial aid. It is how students apply for Federal Financial Aid, including both “free money” and the best and safest loans. Federal and state aid is awarded on a first-come, first-served basis. In short: The sooner your fill out the FAFSA, the better. And remember, the FAFSA need to be filled out EVERY year the student is in college. All student families should complete the FAFSA regardless of income. The FAFSA is one of the factors used by colleges to determine school scholarships. No FAFSA, No Opportunity!

Step 1: The student and one parent need to create an FSA ID. An FSA ID is a username and password that gives you access to Federal Student Aid’s online systems and can serve as your legal signature.

Step 2: Fill out the 2025/26 FAFSA with 2023 tax information.

Although only one parent needs to have a FSA ID to complete the FAFSA, you may need both parent’s financial information on the FAFSA. Use this tool to determine which parent(s) financial information to use.

Federal Student Aid Estimator – use this tool to estimate how much federal student aid the student may be eligible to receive.

Financial Aid Resources

The financial aid process and options can be overwhelming. Below are some resources that ASPIRE suggests researching as you figure out your student’s financial aid:

Oregon Goes to College – How to Pay for College

ECMC Opportunities Booklet: an EXCELLENT resource on all things Financial Aid.

Federal Student Aid website: find detailed information about the FAFSA, the FSA ID, the IRS Data Retrieval Tool, student dependency status, reporting parent information, and what happens after the FAFSA is submitted.

SALT – a great financial aid and college budgeting website

ECMC – a great resource for financial aid guidance and college planning.

How much will college cost?

As you research schools, it’s equally important to research their affordability. Use these tools to forecast your anticipated financial aid package from the schools you are applying to.

Net Price Calculator – Forecast what your college will cost. Each school should have their own Net Price Calculator on their website as well. Search for your school’s specific Net Price Calculator here.

College Score Card – Research the school’s cost, graduation rates, average student debt, and salaries after graduation.

MyinTuition – a great website to help you find out your projected cost of college once financial aid is factored in.

SAI Calculator – use this tool to gain insight on your student’s financial aid eligibility.

ORSAA

In Oregon, students must complete either the FAFSA or the ORSAA to be considered for state-funded grants, including the Oregon Opportunity Grant and Oregon Promise. All students who are U.S. Citizens or Legal Residents should complete the FAFSA. DACA students and other undocumented students who are not eligible for federal student aid programs should complete the ORSAA. All students should note that the FAFSA and ORSAA are not tools that are used to identify undocumented parents or to deport families.

The ORSAA is used exclusively by the state of Oregon, not the Federal government. The Office of Student Access and Completion (OSAC) shares a student’s ORSAA data only with the Financial Aid Office at the school(s) the student listed on the ORSAA. Data from the ORSAA is private, secure information that is not shared with the federal government or other outside entities. Oregon uses the ORSAA to process applications for state grants and other aid programs administered by OSAC.

Federal Financial Aid & Undocumented Students Q&A (PDF)

Other resources for DACA students:

DACA Scholar – download the app!

The Dream Scholarship

Oregon DACA Coalition

Oregon Opportunity Grant

If you’re PELL Grant eligible from the FAFSA, you’ll most likely qualify for an Oregon Opportunity Grant from the Oregon Student Access Commission (OSAC). OSAC uses a formula that considers student, family, and government resources, as reported on the Free Application for Federal Student Aid, to determine grant eligibility and the size of each student’s Opportunity Grant award.

These funds usually run out by the middle of February, so be sure to submit your FAFSA as early as possible! Also, note that if you receive an Oregon Opportunity Grant you can only use the funds at an Oregon institution.

The Oregon Promise

Oregon’s new grant program for community college, known as Oregon Promise, will begin accepting applications on Nov. 1, 2015. The Oregon Promise provides grants for new high school graduates and GED® recipients who will begin community college classes in the Fall 2016 (for eligibility requirements, see info and documents below).

Fact Sheet (PDF)

Application Deadline Tool

Informational Video

OSAC Website with more information

How will OSAC notify students that they have been awarded an Oregon Promise award?

OSAC will notify students of their award via email, and the information will be available in the student’s profile on the OSAC Application Portal. OSAC will also notify schools’ financial aid offices via weekly award lists. Schools include this award information in students’ financial aid award letters.

For other Oregon Promise Q & A visit here.

Evaluating Financial Aid Award Letters

How to compare financial aid letters – use this resource to better read, understand and compare your financial aid letters from colleges.

The Consumer Financial Protection Bureau has a tool that analyzes a financial aid offer, including a detailed examination of student loan debt using estimated salary levels for specific majors at specific institutions.

Financial Aid letters come in many shapes and sizes. When comparing them side by side, we suggest making them look the same. This “Financial Aid Shopping Sheet (PDF) ” is a tool the US Department of Education came up to help make award letters look more uniform. Your institution may already use this form, but if not we recommend transferring the information to this format so it’s easier to read.

**PHS ASPIRE College Financial Worksheet: download this Excel worksheet to compare your letters side-by-side and truly understand what college will cost you. Here is another version from Oregon Goes to College: Compare Costs and Financial Aid.

Use Accepting Aid to understand the different types of financial aid and which ones you should accept.

Compare your financial aid letters side-by-side with this online tool: https://bigfuture.collegeboard.org/pay-for-college/financial-aid-awards/compare-aid-calculator

Compare your package to other students like you at your school at. Make sure you are getting a decent financial aid package.

- Tuition Tracker (www.tuitiontracker.org): This tool shows what students really pay for college, based on their family income.

- College Board (www.bigfuture.collegeboard.org): Search for the school then select the “Paying” tab on the left menu to see the full COA as well as financial aid statistics.

An informative presentation provided by NPR.

College Budget

**PHS ASPIRE College Financial Worksheet: download this Excel worksheet to map out the total cost of your degree – all 2 or 4 years.

Here is another version from Oregon Goes to College: Compare Costs and Financial Aid.

$$$ Paying for College $$$

OSAC has new information (January, 2014) on Oregon’s 529 College Savings Plans at www.oregoncollegesavings.com/news/seminar.shtml. Investment portfolio alternatives, returns, FAQ, and tax advantages are provided.

IRS Publication 970 – Tax Benefits for Education

Other Costs

After tuition and fee’s, there’s many more costs that families don’t plan for. Check out this NPR Article for more information.

Student Loans

Education is the best investment you can make. With that being said, most students use federal loans to help finance their studies and some may turn to private loans. Taking out a loan is an important financial decision that can affect a student for years to come. It is critical for students to understand their loan options and associated responsibilities in order to make good borrowing decisions. If a student’s scholarships and grants (free money – you don’t have to pay it back) are not sufficient to pay tuition and other education-related expenses, students should consider the William D. Ford Federal Direct Loan Program and the Federal Perkins Loan Program. These federal programs offer more repayment options and critical protections for students than private loans. For more information on these options visit:

Private Loans – Private loans should be the last financing option to be considered and used. Private student loans are nonfederal loans made by a lender, such as a bank, credit union, state agency, or a school. They do not typically offer many of the benefits of federal student loans, such as fixed interest rates and income-based repayment plans.

Student Loan Calculators

https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action

http://www.bankrate.com/calculators/college-planning/loan-calculator.aspx

http://mappingyourfuture.org/Paying/standardcalculator.cfm

Another great resource for information on loans, including more calculators: https://bigfuture.collegeboard.org/pay-for-college/loans

How much should I borrow? Borrow only what you need and consider the earnings potential in your chosen profession to determine how easily you can repay your debt. You can find career salary estimates at the U.S. Department of Labor’s Occupational Outlook Handbook at www.bls.gov/ooh. Your student loan payments should be only a small percentage of your salary after you graduate.

General guidelines:

- Parents should fund their retirement BEFORE they fund their child’s education.

- A student should not borrow more than the average first year salary of the profession they plan to have after graduation.

Information from the Consumer Financial Protection Bureau: CFPB Warns Student Loan Servicing Problems Can Jeopardize Long-Term Financial Security for Older Borrowers (view the full Snapshot published by the CFPB Jan 2017(PDF): “Unlike their younger counterparts, who generally are expected to experience income growth over their lives, older consumers typically experience a decrease in income as they age.” For other concerns, read the Snapshot.

- Tips for student loan borrowers

- Tips for older student loan borrowers (parents & grandparents)